...

| Expand | |||||

|---|---|---|---|---|---|

| |||||

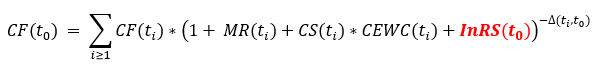

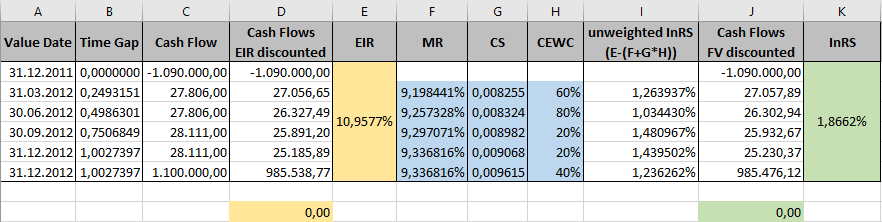

The initial residual spread (InRS) is a constant value which is calculated as a residual amount on the deal conclusion date. The InRS is calculated so that, on the deal conclusion date, the fair value of the deal on the start date corresponds to the cost of purchase, i.e. on the deal start date, the sum of the discounted cash flows corresponds to the cost of purchase. When the “price” of a financial product (e.g. a loan or a bond) is determined by the bank, several components are taken into account, e.g.

Due to the following reason, knowing the InRS is important in the accounting world:

Hence, the InRS can be understood as the profit margin of a deal. Basically, the idea of the InRS is that it will be calculated only once at the beginning of the lifetime of a financial instrument. However, the following situations can be seen as comparable to the “birth” of a new financial instrument so that the InRS has to be recalcualted:

|

...