...

- at which the financial asset or financial liability is measured at initial recognition

- minus principal repayments,

- plus or minus the cumulative amortisation using the effective interest method of any difference between that initial amount and the maturity amount, and

- minus any reduction (directly or through the use of an allowance account) for impairment or un-collectability.

Amortisation based on estimated cash flows helps to smoothen the financial statement by incorporating the prepayment estimation into EIR calculation. With a proper prepayment model:

- At portfolio level, estimated cash flows follow patterns similar to actual prepayments.

- Amortisation already considers prepayment behaviour since prepayment is considered in EIR calculation

Hence, P&L volatility will be much smoother.

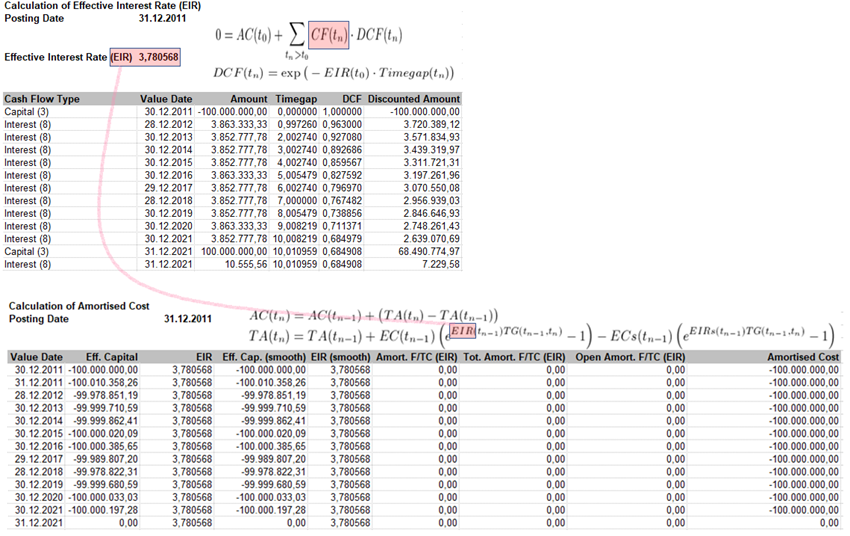

Amortised cost is derived using the EIR which is calculated by means of the cash flow plan:

| Expand | ||

|---|---|---|

| ||

In view of the definition of the amortised cost, the following formula is used for its calculation:

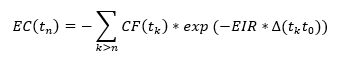

The cumulative total amortisation TA(tn) of payment date tn is defined by

|

...